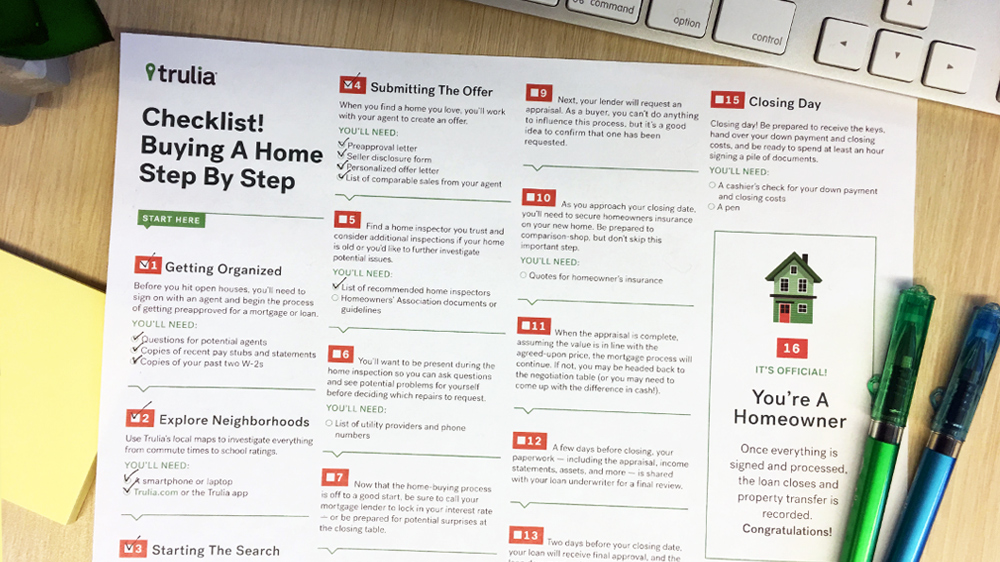

Buying a home can be challenging, with both ups (that gorgeous master bathroom!) and downs (termites, foundation repairs, and leaky roofs, oh my!). But Trulia is here to help. That’s why we’ve put together another handy, printable checklist that outlines the home-buying process and helps make sure you’re prepared for each step along the way, whether you’re browsing for homes for sale in Denver, CO, or Fort Lauderdale, FL.

If you’re just getting started, head to Trulia’s beginner checklist to prep. Then come back here, download this PDF, and get ready to find the perfect new home!

The first steps

Before you start hitting open houses, you’ll need to select and sign on with an agent and begin the process of getting preapproved for a mortgage or loan. Then you’ll be ready to pound the streets with your agent — and submit your best offer when you fall in love with a home.

Recommended reading:

Negotiations, inspections, and repairs

The real fun begins when your offer is accepted! Find a home inspector you trust and consider additional inspections if your home is old or you’d like to further investigate potential issues.

You’ll want to be present during the home inspection so you can ask questions and see potential problems for yourself. Now that the home-buying process is off to a good start, be sure to call your mortgage lender to lock in your interest rate — or be prepared for potential surprises at the closing table. When the home inspections are complete, you’re ready to ask the seller for repairs. Consult your real estate agent to make sure you ask for the essentials (and skip the small stuff that could put your purchase at risk).

Recommended reading:

Final tasks, tying up loose ends

During this part of the process, your lender will request an appraisal. You’ll also need to secure homeowners insurance and make sure utilities are being transferred to your name. Meanwhile, assuming the appraisal is above or in line with your purchase price, the mortgage loan process will continue to move forward with no additional negotiations needed.

Recommended reading:

The closing process

In the days leading up to your closing date, an escrow officer or closing attorney calculates final costs and credits for buyer and seller. On the big day, you’ll sign a stack of paperwork (bring your favorite pen!), hand over a cashier’s check for the down payment and closing costs, and get the keys. Once everything is signed and processed, the loan closes and property transfer is recorded. Next step: Moving!

Recommended reading: