At Trulia, we work to equip you with the tools you need to make informed decisions about buying your dream home. When you’re starting your search, the first thing you should do, and perhaps the most important thing to do, is determine is how much home you can afford, which is why we’ve developed an intuitive Affordability Calculator. The calculator helps you understand your affordability range, debt-to-income(DTI) ratio and more, so you can quickly tailor your search to what’s realistic for you, and move fast in finding your home.

In today’s market, knowing this information is crucial. According to our research, nationally, the typical American worker makes $37,040 annually (national median income) while the typical American house costs $254,900 (national median list price). That means that the median worker would have to spend 42% of their income on mortgage payments if they bought the median-priced home, up six percentage points from two years ago.

Determine How Much You Can Afford

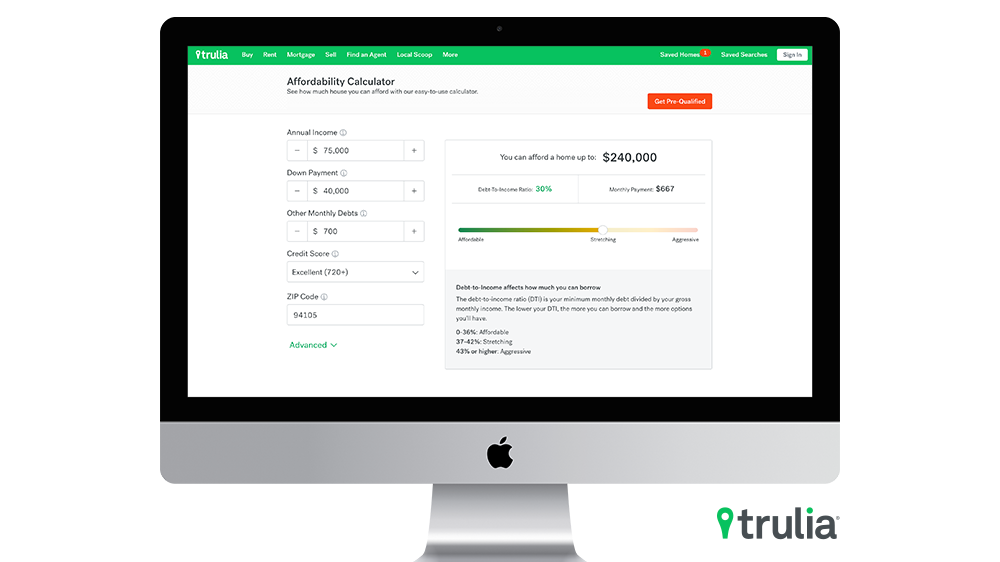

Similar to the Trulia Mortgage app, this new Affordability Calculator takes all important financial factors into consideration when calculating your estimated affordability, such as your annual income, down payment amount, credit score and DTI. To calculate your estimated affordability, you can provide as little or as much information as you want. To get an initial sense of your affordability range, you need to enter basic information, such as your income and down payment amount, but you can always enter more information to increase the accuracy of your estimate, such as your monthly debts, credit score and the zip code of where you want to buy.

See Your Debt-to-Income Ratio

Once you have input all your information, the Affordability Calculator provides you with an estimation of how much home you can afford and helps you understand whether your DTI ratio falls in the safe, stretching or aggressive ranges. DTI is the total monthly debt you have as compared to your monthly income, and is a critical factor in determining your affordability because mortgage lenders typically use it to factor whether or not they should extend home loans to buyers. To be conservative, your DTI should be 36 percent or lower to quality for a mortgage.

Factor in Property Taxes and Interest Rates

The Affordability Calculator takes things a step further by helping you factor in property taxes and interest rates, based on your zip code. This means, you don’t have to do any confusing homework! Simply enter in your zip code, and the cost of property tax and interest rates will be factored into your home affordability estimate.

Contact a Lender

Determining how much you can afford is the first major step in starting your home search; the next is contacting a lender to get get pre-qualified for a loan. Getting pre-qualified is critical – when you inquire about a home, one of the first questions a real estate agent will ask you is whether or not you are pre-qualified. Trulia makes it easy to get in touch with lenders directly from the same page where the Affordability Calculator lives. Simply click on the “Get Pre-Qualified” button at the top of the page to contact a lender.

Trulia’s Affordability Calculator is designed to help you begin your home shopping journey. By understanding your home affordability upfront, you can search for and find homes within your affordability range, helping you move fast and efficiently in your journey.